Land Value Tax (LVT) is not a new concept, yet many with an interest in the policy have noticed a recent uptick in news stories and online discussions on the subject, as well as an increasing number of U.S. municipalities and states giving serious consideration to its adoption. This blog couples descriptions of significant state and community-level efforts with data collected through an online survey, to describe the nature of this apparent increase in interest in LVT.

What is LVT (land value taxes)? First (and most famously) popularized with American audiences by 19th century social reformer Henry George, land value taxes are an alternative to the traditional type of property tax used across the U.S. Both make use of assessed values for properties’ land and improvements, except rather than leveling a single tax rate on the sum of these values, an LVT taxes land values at a higher rate than improvement values (sometimes not taxing improvements at all).

In principle, LVT recognizes that the value of land is largely determined by external factors beyond the owner’s control (such as location and access to community infrastructure). Rather than allowing the economic rent associated with these attributes to accrue to private landowners, an LVT seeks to capture that value to support public expenditures, thus closing this fiscal loop more effectively than a traditional property tax. For these reasons, advocates of LVT often describe the policy as more efficient, equitable, and fairer than traditional property taxes.

Internationally, there are a number of examples of successful LVT implementations. In the U.S., however, adoption of the policy has thus far been restricted to roughly 20 Pennsylvania municipalities and school districts that have experimented with different LVT formulations over the years. Despite the somewhat limited real world data, studies of these PA examples have found statistically significant evidence that the policy yields a number of potentially desirable land use effects (including increased infill development, an uptick in investments to existing structures, and reduced sprawl development), as well as positive economic impacts (including increases in new business formation and reductions in tax delinquency). For these reasons, LVT advocates often speak about the policy as producing simultaneous positive effects in two major arenas: revenue generation and land-use policy.

Where is LVT under consideration? Although Pennsylvania remains the only state to see LVT implemented so far, in recent years a number of active, public debates on the policy have occurred nationwide.

A necessary first step towards new LVT implementations is determination of the policy’s legality, since the application of different tax rates to land and improvement values may violate certain states’ constitutional requirements for tax uniformity. In recent years, several states, including Michigan, Virginia, New York, Oregon, and Minnesota, have either passed or introduced legislation explicitly permitting select taxing jurisdictions to adopt a split-rate structure. Not yet at the point of proposing specific, LVT-enabling legislation, other states, such as Colorado (at the Governor’s behest) and Oregon, have convened tax-focused commissions and committees in which the policy has been given explicit consideration. And although LVT has yet to gain significant mainstream attention in California, many (including CA Assemblyperson Alex Lee) point to LVT as a potential remedy to the distorting effects of the state’s Proposition 13.

Arguably the most visible LVT-focused effort is taking place in Detroit, MI, where in June 2023, Mayor Mike Duggan unveiled a comprehensive land value tax plan for the City, touting the policy’s ability to reduce land speculation and encourage reinvestment. Although not without opposition, the effort has garnered major media attention, and arguably done more to raise awareness of LVT among the general public than any other state or local effort.

What does this increased awareness look like? Google Analytics provides one perspective, illustrated by the LVT Google Searches graphic shown here, which depicts the frequency of searches for “land value tax” in the U.S. over the last decade. The trend line is clearly positive, indicating an increase in searches over time, with the largest relative number of searches taking place since January 2022.

What does this increased awareness look like? Google Analytics provides one perspective, illustrated by the LVT Google Searches graphic shown here, which depicts the frequency of searches for “land value tax” in the U.S. over the last decade. The trend line is clearly positive, indicating an increase in searches over time, with the largest relative number of searches taking place since January 2022.

While Google searches are an important indicator of public interest in LVT, given the Robert Schalkenbach Foundation’s longtime interest in LVT, researchers there wanted to gain a more in-depth understanding of the trend, and conducted an online survey, promoted using the organization’s listserv and social media networks, to learn more.

About the Survey: RSF’s LVT Survey was built in Google Forms and distributed to the Foundation’s ~3,500 person listserv and across its multiple social media platforms between January 26th and February 7th, 2024. The survey was anonymous and no demographic data were requested.

The eight question instrument included queries to determine how long ago respondents first encountered LVT (the only requisite question), whether and why they felt it was a good policy, and what they believed to be the greatest obstacles to LVT’s implementation. Survey respondents were also asked if they knew of, or were involved in any local LVT-related efforts, and whether they would like to be added to the Foundation’s listserv. In all, 340 completed survey instruments were submitted.

The motivations for the survey were two-fold. First, researchers wanted to understand if the recent uptick in media coverage and public debates about the policy have led to increased interest, which would be demonstrated by a high proportion of survey takers indicating that they have recently learned of LVT for the first time. Second, there was a desire to understand any differences in opinion about LVT among individuals who have long been aware of the policy, relative to those who learned about it more recently.

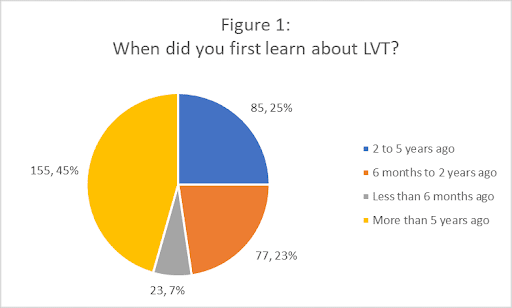

Survey Findings: Of the survey respondents, 45% reported first hearing about LVT more than 5 years prior to completing the survey, 25% had heard of it between two and five years earlier, 23% first encountered the policy between six months and two years ago, and 7% said they had learned about it in the last six months (see Figure 1).

Survey Findings: Of the survey respondents, 45% reported first hearing about LVT more than 5 years prior to completing the survey, 25% had heard of it between two and five years earlier, 23% first encountered the policy between six months and two years ago, and 7% said they had learned about it in the last six months (see Figure 1).

This level of temporal granularity was deemed necessary to determine whether an uptick in LVT awareness can be discerned; a finding supported by the high proportion of survey respondents (55%) who learned about the policy in the last 5 years. Given the similarities in responses among those who encountered LVT for the first time in this more recent period, however, subsequent findings that consider this variable will do so using a more condensed (i.e. 0-5 years, >5 years) categorization.

As might be expected, how respondents first learned about LVT differed according to when that first encounter took place. Individuals who reported knowing about LVT for more than five years listed a variety of information sources as important in this introduction, with formal education (usually either a university-based curriculum or a class at the Henry George School of Social Science) most frequently cited, followed closely by reading a publication (mostly, but not exclusively Progress and Poverty or another book authored by Henry George), and word of mouth (see Figure 2). People who encountered LVT more recently, however, did so overwhelmingly online (73%), either through social media or in another digital forum (see Figure 3). This finding suggests that arenas such as “Georgist Twitter,” Reddit, and a handful of blogs and websites have played an outsized role in influencing the recent uptick in interest in LVT.

As might be expected, how respondents first learned about LVT differed according to when that first encounter took place. Individuals who reported knowing about LVT for more than five years listed a variety of information sources as important in this introduction, with formal education (usually either a university-based curriculum or a class at the Henry George School of Social Science) most frequently cited, followed closely by reading a publication (mostly, but not exclusively Progress and Poverty or another book authored by Henry George), and word of mouth (see Figure 2). People who encountered LVT more recently, however, did so overwhelmingly online (73%), either through social media or in another digital forum (see Figure 3). This finding suggests that arenas such as “Georgist Twitter,” Reddit, and a handful of blogs and websites have played an outsized role in influencing the recent uptick in interest in LVT.

There was overwhelming agreement among all respondents with the statement, “In general, LVT is a good policy” (323 or 95% of respondents indicated that they agreed with the statement, 16 or 4.7% felt “It Depends,” and just 1 person disagreed with the statement). And when asked to describe the most important reason they support LVT, the most frequently selected response (140 responses) identified land use effects (i.e. reductions in sprawl development and speculation, encouragement of infill development, etc.) as the primary reason for their support (see Figure 4).

There was overwhelming agreement among all respondents with the statement, “In general, LVT is a good policy” (323 or 95% of respondents indicated that they agreed with the statement, 16 or 4.7% felt “It Depends,” and just 1 person disagreed with the statement). And when asked to describe the most important reason they support LVT, the most frequently selected response (140 responses) identified land use effects (i.e. reductions in sprawl development and speculation, encouragement of infill development, etc.) as the primary reason for their support (see Figure 4).

Beyond these basic commonalities, however, the survey data suggest some fundamental differences between LVT enthusiasts who’ve long known of the policy and those who have encountered it more recently.

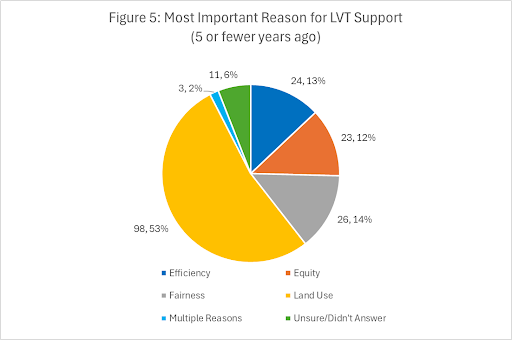

While land use effects were universally cited as an important reason for support, LVT newcomers are much more likely than those who’ve been aware of LVT for longer to emphasize this as the most important reason for their support. In fact, the difference in response distributions across the groups was very highly statistically significant (p=.00001), with those reporting knowledge of LVT dating back more than five years identifying the policy’s more ideological characteristics (its fairness, in particular) nearly as often as its on-the-ground effects as their reason for support (see Figures 5 and 6).

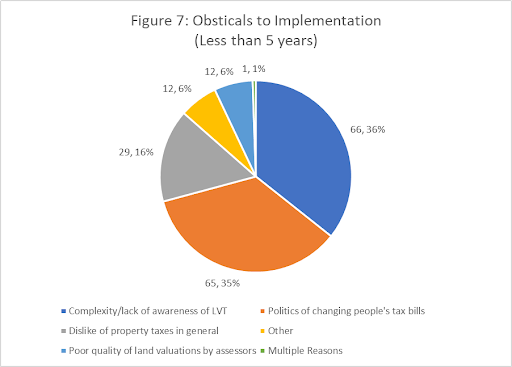

When asked to identify what they perceived as the greatest obstacle to LVT implementation, concerns over the politics of changing people’s tax bills (113 responses) and the lack of awareness and complexity of the policy (107 responses) were most often cited by the survey sample as a whole. But once again, there were statistically significant differences between the responses given by long-time LVTers, those of respondents who first encountered the idea in the last 5 years. A greater (but not statistically significant) proportion of respondents who had heard of the policy recently were concerned with difficulties arising from LVT’s complexity. These survey takers were also much less likely to identify an obstacle that did not fit into one of the answer categories included in the survey (responses classified in the “other” category) or to list multiple reasons as potential obstacles to adoption (see Figures 7 and 8). Among both groups, however, some version of the idea that LVT flies in the face of the American ideal of rentierism was often described by those who selected “other” as the greatest obstacle to adoption.

Respondents’ knowledge of local level LVT efforts varied. Many indicated that they (often regrettably) were not aware of any such efforts, or cited the work in Detroit or another of the locales listed above. A handful lamented the existence of California’s Proposition 13 as preventing adoption in what would otherwise be an ideal location. And a few described very nascent efforts of which they were a part or at least aware.

Respondents’ knowledge of local level LVT efforts varied. Many indicated that they (often regrettably) were not aware of any such efforts, or cited the work in Detroit or another of the locales listed above. A handful lamented the existence of California’s Proposition 13 as preventing adoption in what would otherwise be an ideal location. And a few described very nascent efforts of which they were a part or at least aware.

Clearly, perceptions of an uptick in interest about LVT are borne out, both by Google Analytics and the survey results reported here. Interestingly, the survey findings also suggest that a shift is taking place in how people are first encountering the policy and what they perceive as its appeal, as evidenced by newcomers’ tendency to learn about LVT online and place a much greater emphasis on its on-the ground effects. These findings make sense as they mirror the overarching trend toward digital communications, and the recent state and municipal LVT efforts, many of which are motivated primarily by desires for impacts such as infill development and the production of affordable housing.